LIC New Jeevan Labh Plan (936)

LIC New Jeevan Labh Plan (936) Summary

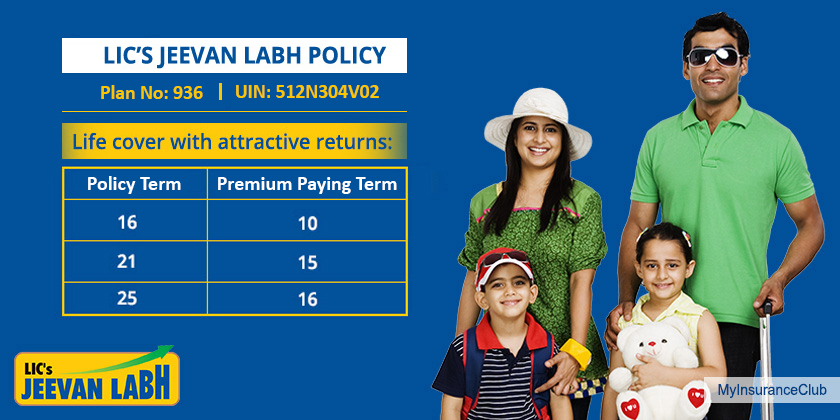

LIC Jeevan Labh is a simple endowment plan. You pay premiums for a limited period of time and at the end of the policy term, you will get the Maturity Benefits. In case of death of the policyholder anytime during the policy term, the nominee will get the Death Benefit.

LIC Jeevan Labh Policy is a traditional, non-linked, with-profit plan offering investment and insurance benefits. It is a limited premium payment plan – you don’t have to pay the premiums for the entire duration of the term of the policy. We will explain the plan benefits with the help of an example.

| Launch Date | 1st February 2020 |

| Table Number | 936 |

| Product Type | Endowment |

| Bonus | Yes |

| UIN | 512N304V02 |

Benefits

We have Sumit Roy, age 35 who wishes to buy this plan. He goes in for the plan with the following:

Sum Assured - Rs. 2,00,000

Term - 25 years. Based on this the premium payment term gets decided

Premium Payment Term - 16 years

Based on these parameters, his annual premium would be:

For 1st Year - Rs. 9,290 + 4.5% GST = Rs. 9,708

2nd Year onwards - Rs. 9,290 + 2.25% GST = Rs. 9499

Scenario 1: If Sumit dies after 3 policy years - The nominee would get the Sum Assured + Simple Reversionary Bonus + Final Addition Bonus.

Total Premiums Paid = Rs 28,706

Sum Assured = Rs. 2,00,000

Simple Reversionary Bonus = Rs. 47 per 1,000 Sum Assured for 3 years i.e. (Rs. 47 x 200 x 3) = Rs. 28,200. Here we have assumed that every year a bonus of Rs. 47 per 1,000 Sum Assured is being declared every year. This is just an assumption and it may be higher or lower than this.

Final Addition Bonus - Nil. Usually, the Final addition bonus is declared after a much longer premium payment term.

So the nominee will get Rs. 2,00,000 + Rs. 28,200 = Rs. 2,28,200

Scenario 2: If Sumit dies after 15 policy years - The nominee would get the Sum Assured + Simple Reversionary Bonus + Final Addition Bonus

Total Premiums Paid = Rs 1,42,694

Sum Assured = Rs. 2,00,000

Simple Reversionary Bonus = Rs. 47 per 1,000 Sum Assured for 15 years i.e. (Rs. 47 x 200 x 15) = Rs. 1,41,000. Here we have assumed that every year a bonus of Rs. 47 per 1,000 Sum Assured is being declared every year. This is just an assumption and it may be higher or lower than this.

Final Addition Bonus - Rs. 20 per 1,000 Sum Assured i.e. (Rs. 20 x 200) = Rs. 4,000. Here we have assumed a one-time Final Addition Bonus of Rs. 20 per 1,000 Sum Assured. This is just an assumption and it may be higher or lower than this.

So his nominee will get Rs. 2,00,000 + Rs. 1,41,000 + Rs. 4,000 = Rs. 3,24,000

Scenario 3: If Sumit survives till the end of the policy term of 25 years - Arvind will get the Sum Assured + Simple Reversionary Bonus + Final Addition Bonus

Total Premiums Paid = Rs. 1,52,193

Sum Assured = Rs. 2,00,000

Simple Reversionary Bonus = Rs. 47 per 1,000 Sum Assured for 15 years i.e. (Rs. 47 x 200 x 25) = Rs. 2,35,000. Here we have assumed that every year a bonus of Rs. 47 per 1,000 Sum Assured is being declared every year. This is just an assumption and it may be higher or lower than this.

Final Addition Bonus - Rs. 450 per 1,000 Sum Assured i.e. (Rs. 450 x 200) = Rs. 90,000. Here we have assumed a one-time Final Addition Bonus of Rs. 20 per 1,000 Sum Assured. This is just an assumption and it may be higher or lower than this.

We have Sumit Roy, age 35 who wishes to buy this plan. He goes in for the plan with the following:

Sum Assured - Rs. 2,00,000

Term - 25 years. Based on this the premium payment term gets decided

Premium Payment Term - 16 years

Based on these parameters, his annual premium would be:

For 1st Year - Rs. 9,290 + 4.5% GST = Rs. 9,708

2nd Year onwards - Rs. 9,290 + 2.25% GST = Rs. 9499

So Sumit will get Rs. 2,00,000 + Rs. 2,35,000 + Rs. 90,000 = Rs. 5,25,000

Check the Bonus Rate of LIC Jeevan Labh Plan (need to update)

- Free-look Period – If the policyholder is not happy with the plan, he can cancel the policy within 15 days of the plan issuance. This period is called the free-look period. Upon cancellation, the premium paid net of any applicable expenses would be returned.

- Grace Period - In the case of Yearly, Half-yearly, and Quarterly premium payment mode you have a grace period of 30 days from the premium due date. In the case of monthly premium payment mode, the grace period is 15 days.

- Revival Period - You can revive your lapsed policy within 5 years of the last premium paid.

- Loan - You can avail loan against this policy after you have paid 2 years of premium.

- Riders - You have the choice of taking the following riders by paying an extra premium amount:

- LIC's Accidental Death and Disability Benefit Rider

- LIC's New Term Assurance Rider

- LIC’s New Premium Waiver Benefit Rider

- Surrender Value - If you surrender the plan anytime before paying 2 years of premiums, you will not be paid anything back. In case you have paid at least 2 years’ premiums, the policy will acquire a Surrender Value. The bonus which you get in the policy also has a surrender value. Click here to understand the Surrender Value Calculations in the LIC Jeevan Labh Plan.

How it works

When buying the LIC Jeevan Labh Plan, the customer has to decide on the following:

- Sum Assured (this is the amount of cover that you want)

- Policy Term (this is the period for which you wish to have the cover). The premium payment term gets decided automatically based on the policy term as follows:

- If you select a policy term of 16 years, you have to pay premiums for 10 years

- If you select a policy term of 21 years, you have to pay premiums for 15 years

- If you select a policy term of 25 years, you have to pay premiums for 16 years

Based on the above 2 factors and the age at which you are taking the policy, your annual premium will be decided.

Since it is a Participating plan, you will be eligible for the following at various points through the policy term. These are not guaranteed and you will only know the values as and when they are declared by LIC.

- Simple Reversionary Bonus

- Final Addition Bonus

Tax Benefit

- Premiums – The premiums paid for the plan are exempt from taxation under Section 80C of the Income Tax Act.

- Maturity Claim – Maturity amount is exempted from tax under Sec 10(10D) of the Income Tax Act

- Death Claim – Death claims received under the plan are free from taxation under Section 10(10D) of the Income Tax Act

Eligibility

| Minimum | Maximum | |

|---|---|---|

| Sum Assured | Rs. 2,00,000 | No-Limit |

| Policy Term(in years) | 16,21,25 | |

| Premium Paying Term(in years) | 10 for 16 years of the policy term | |

| 15 for 21 years of the policy term | ||

| 16 for 25 years of the policy term | ||

| Age at Entry | 8 years (completed) | 59 years for policy term 16 years |

| 54 years for policy term 21 years | ||

| 50 years for policy term 25 years | ||

| Maximum Maturity Age | 75 years | |

| Premium Paying Frequency | Annually, Half-yearly, Quarterly, Monthly | |